Table of contents

Did you know that most newlyweds take on debts for weddings?

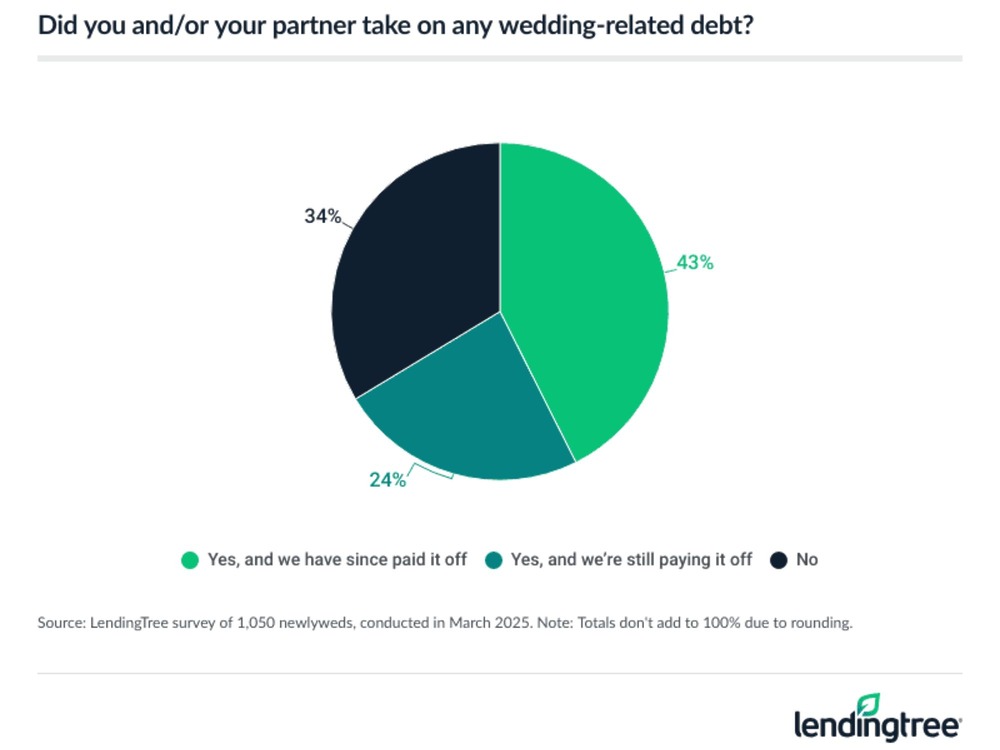

According to a LendingTree survey, 67% said they got loans to fund their weddings, with nearly 25% still paying them off. Only 34% didn’t have any debt for the wedding at all.

So, how can you be wise with your wedding debts and avoid financing pitfalls? Keep on reading to find out the answer to this crucial question.

The Real Wedding Cost and Common Financing Pitfalls

The wedding is said to be the biggest day of your life—you’ve got to make it extra special. But here’s the sad reality: it can be very costly. Think of all expenses involved, from the initial wedding video and photography up to the wedding destination, venue, food, and accommodation.

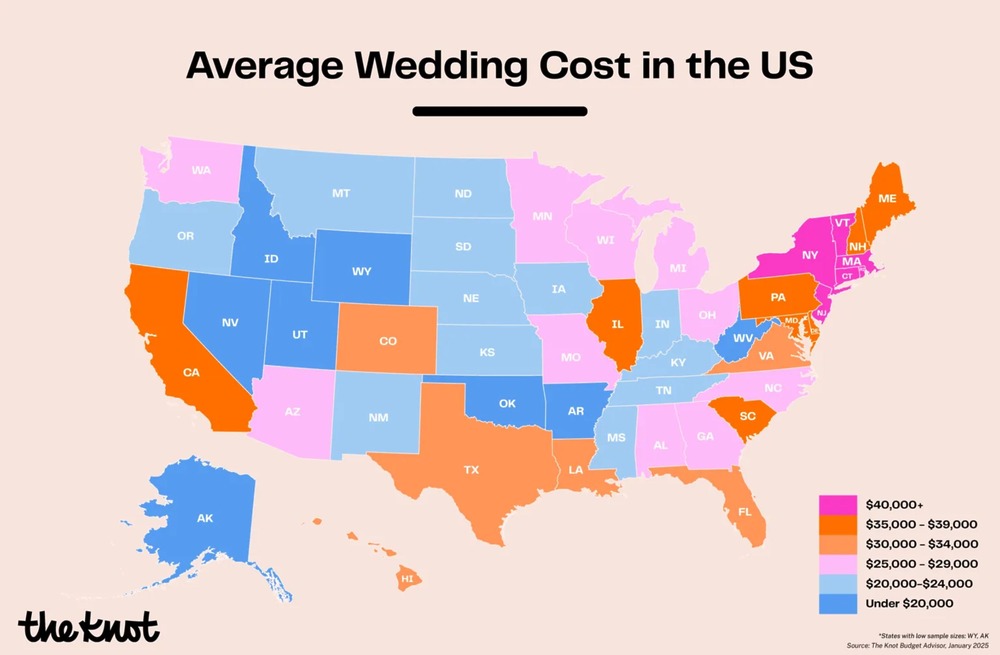

According to The Knot, the average total cost of a wedding in the U.S. was $33,000 last year. The price tag went as low as $16,150 in Alaska to as high as $54,400 in New Jersey. Couples spent about an average of $12,200 on average for the venue alone—what about the catering, decors, souvenirs, and other related expenses?

What about the predicted average cost of a wedding this year? For Zola, it’s going to be around $36,000 in 2025, from $33,000 in 2024 and $29,000 in 2023.

In fact, the cost of a destination wedding alone ranges from $1,350 to $11,000 worldwide. However, these figures are significantly lower than the U.S. average wedding expenses, which are around $30,000. Still, the truth of the matter is that a wedding can be expensive.

That’s why it’s easy to see some couples incur debts for their weddings. That said, here are common financing pitfalls you should avoid at all costs:

- Getting high-interest loans: Personal loans are readily available in the market. You can easily and quickly apply for one, whether through a traditional or digital bank. But if you don’t perform due diligence, you might fall into a loan with a high interest rate.

- Relying much on credit cards: It’s easy to see people rely heavily on their credit cards for day-to-day transactions. However, you might solely depend on these cards for all your wedding-related expenses. You might even go as far as getting a cash advance to finance your big day.

- Not establishing a realistic budget: Sure, you might have a list of all wedding expenditures and set aside a budget for each. However, your financial resources might not be enough to cover all these expenses. The bottom line? Be as realistic as possible with your wedding budget!

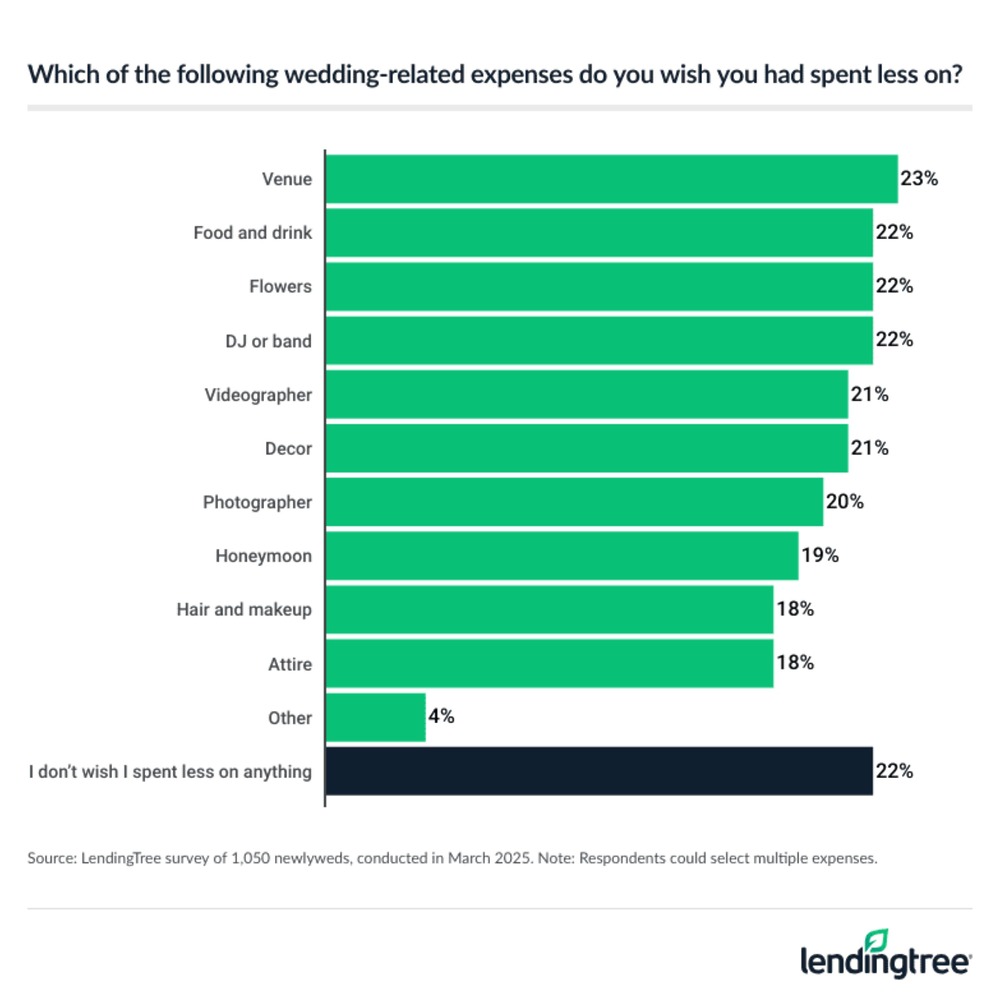

- Overspending on the non-essentials: Of course, you want to make the most of your biggest day. However, you could spend too much on non-essentials like wedding photos, videos, and even souvenirs. Needless to say, focus on the essentials first before you make miscellaneous expenses!

- Not discussing with your partner: Unfortunately, some couples don’t communicate about their wedding finances through and through. However, it’s crucial to plan and budget for each and every expense. For example, ask yourself: Who pays for the wedding destination?

Learn how to avoid financing pitfalls for your wedding in the next section.

How To Stay Smart with Your Wedding Finances

Planning for your wedding involves a lot, from creating a guest list down to setting up the venue. However, your finances are the most critical in the overall equation. You need enough money to make your dream wedding come true.

That’s why some couples resort to debt to finance their wedding. If you haven’t saved enough, you have the option to apply for personal loans, use your credit cards, or try alternative financing options. However, the key is here to stay debt-smart so you won’t end up!

That said, here’s how to become wise with your wedding finances and avoid debt problems in the future:

1. Set an all-inclusive yet realistic budget

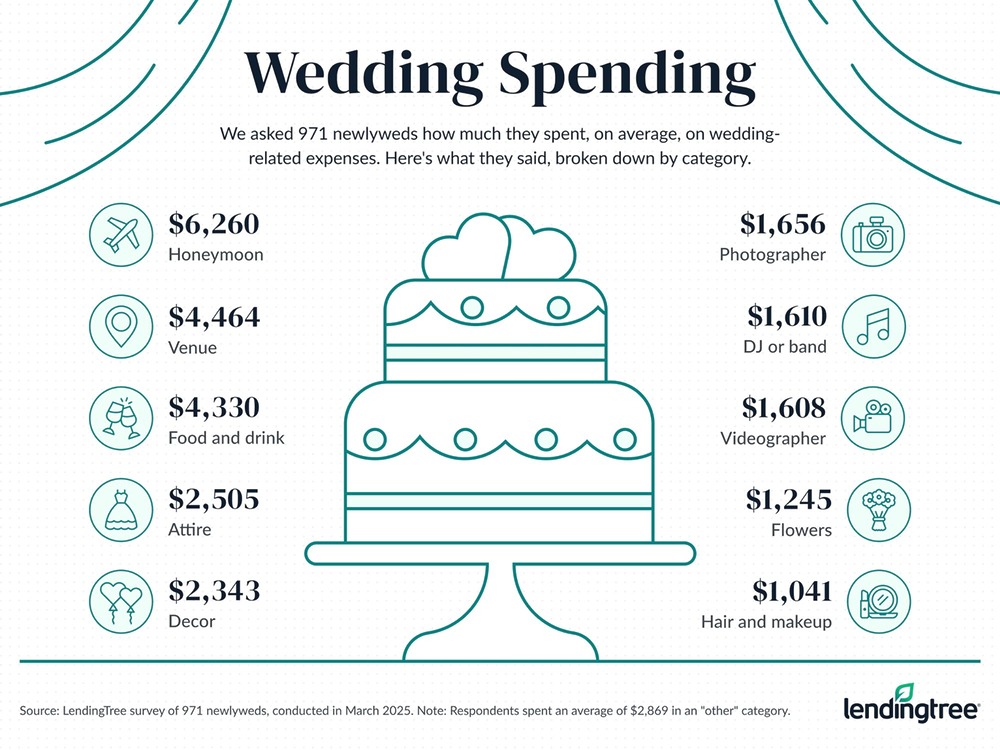

As with any financial endeavor, setting a clear budget is crucial. As far as your wedding is concerned, be as realistic as possible. This entails listing all your potential expenses and allocating a specific budget for each. That said, here’s a list of wedding expenditures from the same LendingTree survey for your reference:

But first, you and your partner should assess your current financial situation. With a list of all wedding costs and the money you currently have, decide if you need to take on a debt. More importantly, see how you can save up on your wedding through proper budgeting.

For example, consider a cheap wedding venue in Mexico if you’re looking to have a wedding destination out of the country. Dreams Riviera Cancun Resort & Spa, Hard Rock Riviera Maya, and Hyatt Ziva Puerto Vallarta can be your best bet based on the deals and offers. And that leads us to the next step: knowing what to prioritize.

2. Prioritize what matters the most for you

Of course, you want to make the most of your wedding day. You want to make it extravagant in almost all aspects—from the wedding destination down to your guest tokens. But as mentioned, you must be financially realistic—focus on the essentials first. Take the common expenditures involved in a wedding listed by the same LendingTree survey below:

The wedding venue and accommodation, as well as food and beverages, are the most important considerations. You should also consider the wedding attire, not to mention the hair and makeup. So, if you’re looking to get loans for all the expenses, spend only on the essentials and have proper budgeting. For instance, opt for affordable wedding packages in Jamaica that include all the things you need.

3. Explore financing options with low interest

In today’s wedding scene, getting personal loans has become increasingly prevalent. You can always take out a loan for your wedding destination, food, and other related expenses. However, you must opt for lenders offering loans with lower interest rates. This means conducting due diligence on the best offer before making a decision.

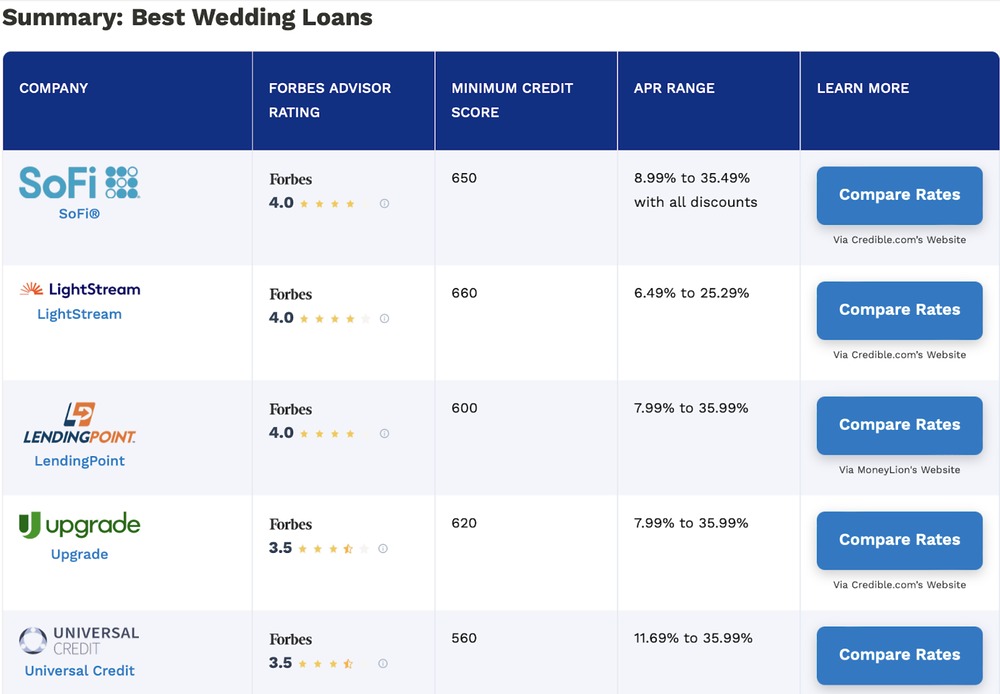

Don’t worry–financial institutions and digital banks offer personal loans to couples looking to tie the knot. Simply contact your bank to find the best deals, or search online to explore various financing options. But for your reference, consider CNBC’s top lenders with the best personal loans for weddings:

Forbes Advisor lists the best wedding loans in 2025 based on loan cost, details, eligibility, customer experience, and application process. Consider one or some of these options.

4. Consider getting alternative funding

The best way to finance your wedding is to plan and save enough money. However, it’s common for couples to use their credit cards or get personal loans to fund their weddings. They also resort to alternative financing options, such as seeking contributions from family and friends or exploring crowdfunding platforms for their wedding.

Yes, you can always seek help from people to finance your big wedding day. Your friends and family will be more than willing to support you. And there are many other options available to help you get by thereafter. For example, you can enroll in a debt relief program to consolidate all your wedding debts and guide you in getting back on track.

5. Consult a financial wedding advisor

Staying on top of your finances and managing your debts can be debilitating. You might have lots on your wedding plate to consider. That’s why it’s best to consult a financial advisor the same way as working with a wedding planner. A finance professional can help you save up, get financing options, and ultimately manage your debts.

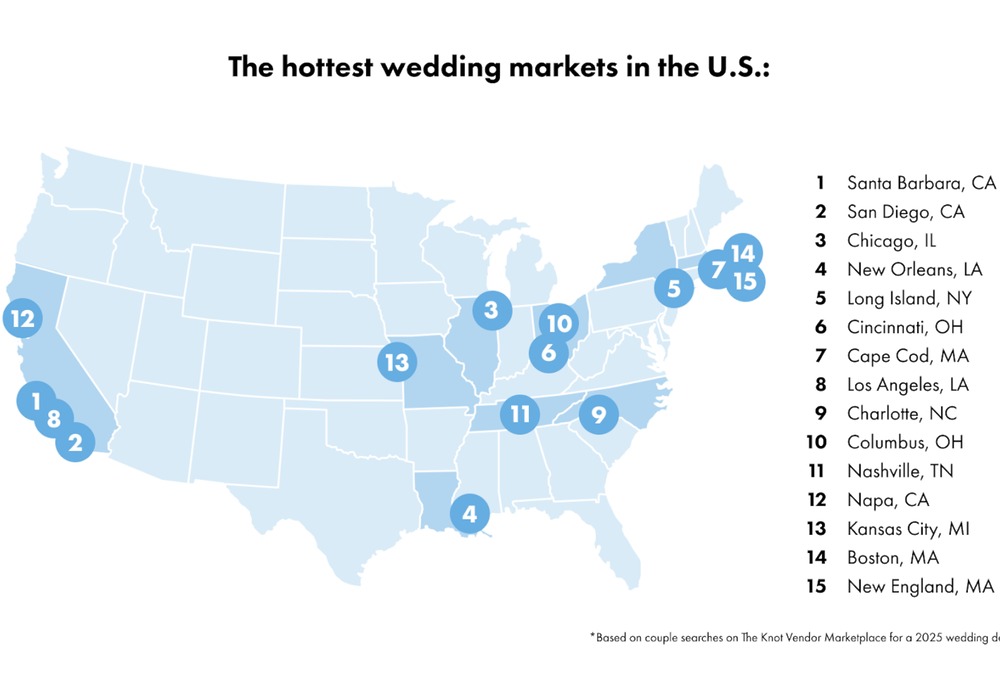

For example, you can specifically ask your financial advisor for an affordable wedding destination. They can research and recommend all-inclusive resorts for free weddings for you to choose from. They can refer you to the best wedding markets in the country, such as the following states:

But if you’re looking to have your wedding destination elsewhere, they can refer you to top countries for weddings, such as the destinations below. Then, they can dive into the nitty and gritty of saving up for your wedding. Simply put, your financial advisor can help you manage your wedding finances.

Final Words

Generally, it’s best to save money to make your wedding the best day of your life. However, taking on debts to fund your big day is sometimes inevitable. So, whether you use your credit card, apply for a loan, or get alternative funding, avoid the financial pitfalls mentioned above.

More importantly, consider our expert advice for handling your wedding finances and managing your debts. Set a clear budget, focus on the essentials, opt for low-interest rates, consider alternative options, and talk to a financial advisor.

With all these practical tips and steps, you can have the best wedding of a lifetime—without breaking the bank! To plan for your wedding in a debt-smart way, get in touch with us today!